Wafer cleaning Clean/Wet equipment market analysis

The entire semiconductor process needs to be repeatedly cleaned, and the cleaning process runs through the semiconductor industry, accounting for more than 30% of the total production process. From the analysis of the output value of the entire semiconductor industry equipment market, the wafer processing equipment accounts for 80%, and the total production value of the cleaning step accounts for about 33% of the wafer processing equipment, and the cleaning equipment plays a crucial impact on the pass rate and economic benefits of the production line.

According to SEMI data, the global wafer cleaning equipment market space is $3.7 billion in 2020, accounting for 5% of all equipment. Among them, Screen Electronics Co., the top three in the wafer cleaning equipment market. , Ltd. Together, Screen, Tokyo Electron Limited (TEL) and Lam Research Corporation (Lam) account for 87.7 percent of the wafer cleaning equipment market. Guangfa Securities semiconductor cleaning equipment industry in-depth research report shows that in 2019, the global demand for megatound cleaning machines is 221 units, and only the megatound cleaning machine market can reach $663 million. Naura Chuang, to pure technology accounted for less than 1%. With the transfer of the semiconductor industry to China, the domestic market space is increasing, potential customer resources are abundant, and the cleaning machine needs to cover the latest domestic process. According to Guangfa Securities estimates, in the five years from 2019-2023, the cleaning equipment market space of mainland companies will reach more than 40 billion yuan. The table is the wet cleaning machine market share and domestic market share measured by GF Securities.

The company is the global leader in cleaning equipment, with 45.1 percent of the global semiconductor cleaning equipment market share, according to SEMI, with 60 percent of its revenue coming from SU3200 cleaners that can be used in 7nm processes. Founded in 1868, the company developed the first generation of wafer cleaning equipment in 1975. In the following 40 years, the company focused on the research and development and promotion of wafer cleaning equipment, providing semiconductor cleaning equipment based in Japan and for the world. The market share of the three most important cleaning equipment fields of single wafer cleaning equipment, automatic cleaning table and washing machine occupies the first place in the world, and it is the leader of cleaning equipment technology. At present, the company is headquartered in Japan, and has branches in the United States, Europe, South Korea and Beijing, Tianjin, Wuxi, Wuhan, Dalian, Shenzhen and Taiwan in China. The sales network of cleaning equipment covers Intel, TSMC, Samsung, SK Hynix, SMIC, Huahong and other international well-known giants.

The latest generation of cleaning equipment is the SU-3300, which is derived from the long dominant SU series, starting with the SU-2000, SU-3100, SU-3200, SU series has been at the forefront of the chip process used in the high-end cleaning machine. As is shown in the picture:

Tokyo Electronics is the second largest wafer cleaning equipment company after Dean, as of June 2020, it has sold more than 62,000 sets of cleaning equipment worldwide, and is the first company to steadily manufacture 11 ultra-high purity wafers. Founded in 1963, Tokyo Electronics merged with Thermco Products Corp in 1968 to become the first semiconductor manufacturing equipment manufacturer in Japan, and began designing and manufacturing wafer cleaning equipment in the same year, and became the top cleaning equipment supplier in 1981. In 1989-1991 even surpassed Dean for three consecutive times of cleaning equipment champion, in the following two decades, Tokyo Electronics has also been firmly ranked second in the world wafer cleaning equipment throne.

Tokyo Electron's latest generation of cleaning equipment products is the CELLESTA SCD, CELLESTA series products are widely used to clean silicon wafers in semiconductor processes, including small size chips, complex logic chips and memory DRAM used in PC or NB. As is shown in the picture:

Pangilin Semiconductor is the brainchild of David K. Lam's semiconductor technology company, founded in 1980 and headquartered in Silicon Valley, California, is one of the world's leading suppliers of wafer manufacturing and services, with an overall share second only to ASML and AMAT, ranking third in the world. In the field of wafer cleaning equipment, Panglin Semiconductor Company is also ranked third in the world after Dean and Tokyo Electronics Company, accounting for about 12.5% of the global market in 2019.

The latest generation of Pan Forest cleaning equipment is the Coronus HP

As shown in the figure, this wafer cleaning system uses plasma confinement technology to effectively protect the chip area; In situ removal of thin film layers and residues of various materials and selective removal of unwanted materials from wafer edges can improve production efficiency and improve product yield; The metal film can be eliminated, which can prevent arc formation in subsequent plasma steps.

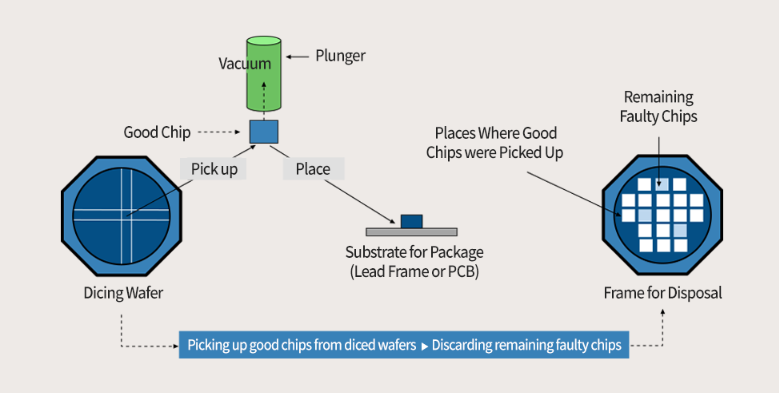

Semi Semiconductor has two self-developed core technologies -SAPS (space alternated phase shift) and TEBO (timely energized bubble oscillation) cleaning technology. The two have solved the problems of megasound energy distribution uniformity and destructive energy, and have a number of core patents and technologies in the field of megasound cleaning. In response to the large amount of high-concentration, difficult-to-treat sulfuric acid wastewater discharged during the chip production process, Sheng Mei exclusively invented the first high-temperature sulfuric acid cleaning equipment -UltracTahoe, a feature of this equipment is to reduce the amount of sulfuric acid used by 90%, reducing the impact of the semiconductor industry on the environment.

As shown in the figure, in view of the problem that the traditional slot cleaning technology is not clean enough in the process below 28nm, UltracTahoe has developed a new generation of combined cleaning equipment by first cleaning the chip in the slot, and then the principle of single piece cleaning, which can reuse sulfuric acid and achieve high clarity cleaning effect, which can reduce environmental pollution and save huge costs.

Fountyl Technologies PTE Ltd, is focusing on semiconductor manufacturing industry, main products include: Pin chuck, porous ceramic chuck, ceramic end effector, ceramic square beam, ceramic spindle, welcome to contact and negotiation!