Chip trend: New battles and new battlefields for silicon carbide

At present, the rapid development of silicon carbide market on the one hand, there is a competitive situation of price reduction, on the other hand, new market applications are also appearing. Secondary market expectations have also changed. About a year ago, in July 2023, the global silicon carbide material giant Wolfspeed's stock price was still around $70 / share, and it has fallen to around $23 / share. This may be related to the company's recent poor financial performance and the capital market has lost confidence. Silicon carbide players in the domestic market are also actively racing, especially driven by the demand of domestic Oems, it seems that the latter also has more competitive space.

"I personally believe that in the long run, because the domestic new energy automobile industry chain has more development precipitation, which as the largest application of silicon carbide landing market, it means that the domestic silicon carbide industry development has a better development soil." Although there is still a certain gap between the advanced level of major countries in Europe and the United States, I believe that with the completion of technical reliability verification in China, it will soon develop." An executive of a silicon carbide industry company so analyzed to the 21st Century Business Herald reporter. In addition to the rapid landing of new energy vehicles, new demand is also emerging. The executive pointed out that AI servers and low-altitude economy are quite good next application market.

New Campaign

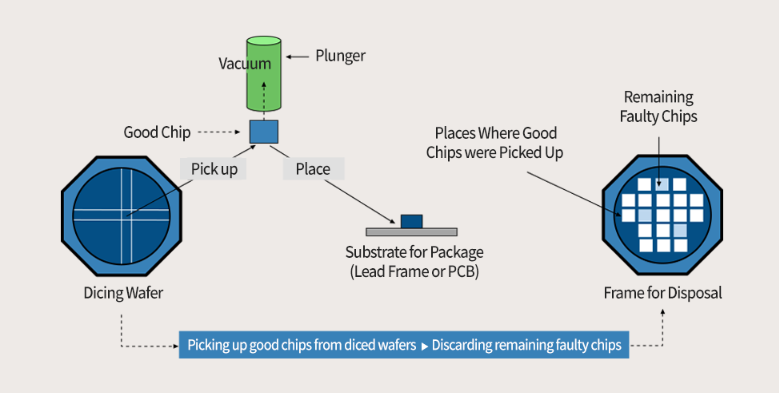

With the related production capacity of silicon carbide industry chain gradually rich, and the driving force of new energy vehicles in the largest application scenario, the global silicon carbide market is ushering in changes. Partly as a result, Wolfspeed's share price is bearish. The aforementioned silicon carbide manufacturer executives analyzed to the 21st Century Economic Herald reporter, as the industry took the lead in promoting the mass production of 8-inch silicon carbide wafers, Wolfspeed stepped earlier, and the company was originally a material supplier, its conversion to wafer manufacturers are also facing a certain lack of experience in the problem. This led to a long period of time, Wolfspeed's proud 8-inch silicon carbide wafer production capacity, its capacity utilization has not been high. On June 24, the company disclosed that its SiC wafer fab in Mohawk Valley had reached 20% utilization. By the end of 2024, Mohawk Valley Fab is expected to increase its wafer start-up utilization to approximately 25%. This means that for a long time, the company's capacity utilization rate fluctuated only at a low level.

The aforementioned executive also pointed out that the other reason for Wolfspeed's failure is that the largest application scenario of the current silicon carbide device market is new energy vehicles, and the world's largest demand market is undoubtedly in China. As China's more silicon carbide industry chain is racing technology, domestic related product prices are declining rapidly, resulting in Wolfspeed's product competitiveness is being eroded. The whole industrial chain of silicon carbide is in the price reduction, is the product of the development of the industry to a certain stage, but also driven by application demand.

Recently, at the third IC NANSHA conference sponsored by Core Research, Chen Jian, COO of Zhancore Electronics, analyzed that the application market is more looking forward to buying better products at lower cost. Therefore, the silicon carbide industry also needs to comply with the industry trend of new energy vehicle roll price, roll technology and roll configuration. "By the end of next year, after the launch of our new generation of products, the cost can be further reduced by 15%." This depends on the upstream manufacturers' volume ', silicon carbide substrate has recently reduced prices, otherwise it is difficult to achieve this goal."

Chen Jian admitted that the current silicon carbide device market is being led by overseas head manufacturers to open the "volume", "the agent's quotation and the beginning of the year directly dropped by half, we must be ready." They can rely on technological innovation to deliver cost reductions and a commitment to quality, and if they don't compete with them, they will throw in the towel." Song Huaping, chairman of Zhongke Huizhu, also pointed out that, on the whole, while the industry is doing a good job of technology, the price is also sinking quickly. "In 2024, the epitaxial sheet + substrate price fell below 5 characters, and the 1200V price war was very rapid." But this price war has to be fought, not to fight will not be able to improve the technology. We will not only make new technologies, but also make up our minds to accompany people to roll traditional extension products." How to deal with this new competitive situation? Chen Jian said that in the short term, it is indeed facing the trend of low stage demand and high inventory, and the silicon carbide industry chain is facing this challenge. However, it is still optimistic about the application process of silicon carbide devices in the long term.

In this case, it is necessary to do a good job of the "triangle" of company operations (cost, delivery, quality). "To the left is technological innovation, model innovation, expansion, legal escort technology patents; To the right is a conservative route, reducing quality and shoddy. We choose a long-term development path, so the play is to the left 'roll'." Chen Jian said that in terms of substrate innovation, it can explore liquid phase method, cutting and polishing, stripping technology; In terms of epitaxy technology innovation, rapid growth, defect engineering, super junction epitaxy and other routes can be developed. In addition, there is room for further breakthroughs in many industrial chain links such as manufacturing process, packaging technology, and equipment. It is an important way to cooperate with the upstream and downstream. Chen Jian also proposed that the domestic silicon carbide market should also learn from the high-end trend. Therefore, we can not ignore the "volume" in terms of standards and patents, and the technology licensing in the Ningde era is a typical example of this kind. The shift is already seeing the emergence of patent companies in this area.

New Battlefields

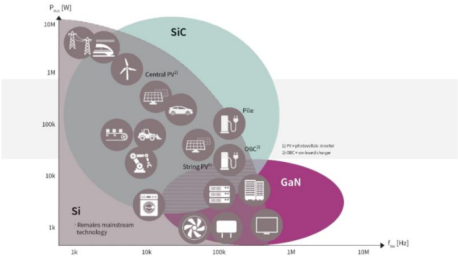

As one of the third generation semiconductors, new battlefield silicon carbide has attracted much attention because of its unique physical properties. CTO Xiangqi analysis, as the pace of clean energy replacement of fossil energy is getting faster and faster, there is a large amount of energy conversion demand in the middle, resulting in the demand for power semiconductor products. At the same time, the rapid development of the AI industry requires a lot of power support behind the large computing power, which requires a more effective use of clean energy. Under the trend of energy change, silicon carbide is very suitable for power semiconductor products because of its material characteristics, which ushered in development opportunities. Although the overall cost of silicon carbide power devices is higher than similar silicon devices, Xiangqi analysis said that the former application can actually bring systematic cost reduction. "The reason is that one of the characteristics of silicon carbide is that the switching speed is relatively fast, and in many system-level applications, this feature can greatly reduce the use of non-connected devices, that is, the use of capacitors and inductors can be reduced."

In addition, as the aforementioned price competition continues, it will mean that more industries are willing to use silicon carbide as a new material product, which is conducive to further expanding its application market. Third-party statistics show that in the field of silicon carbide applications, new energy vehicles are still the largest application market, accounting for about 70% at present, of which the main drive is the largest single market, accounting for 90% of the new energy vehicle market.

As overseas manufacturers have taken the lead in this field, many domestic manufacturers are currently carrying out the safety and reliability certification process of relevant products, so they have been seized by overseas first-mover advantages. The executive told reporters that it is expected that about this year and next year, it may usher in the first year of domestic silicon carbide device products "on the car", and then it will face direct competition with overseas manufacturers, and the domestic industrial chain needs to form a joint development force to cope with market competition. Xiangqi cited third-party data pointed out that McKinsey statistics in October last year showed that 97% of the world's silicon carbide supply from European, American and Japanese companies, Chinese companies have not yet entered the head camp, "We hope not to be in the 3% of the 'volume', but to make this 3% to 30%, which is the direction of the 'volume'."

Of greater concern are the new markets to be tapped. Xiangqi pointed out that in addition to new energy vehicles, wind, light, storage, high-voltage power transmission are the main application scenarios of silicon carbide. There are two potential markets to watch these days: the data center and the low-altitude economy. Some people say that low-altitude aircraft are more suitable for silicon carbide applications than new energy vehicles, because low-altitude aircraft are not so sensitive to cost, the degree of freedom in reliability design and system design will be relatively large, and some redundant design can be done, making reliability problems easier to solve. So the low-altitude economy is a potential silicon carbide application market that we are very excited about." "He continued. Jibang consulting analyst Gong Ruijiao also believes that in order to meet the higher level of AI computing, chip power consumption is increasing, and the power density of server power is put forward higher requirements, silicon carbide, gallium nitride has become one of the key technologies to optimize energy efficiency, and the corresponding demand has increased significantly in recent years.

FOUNTYL TECHNOLOGIES PTE. LTD. is a modern enterprise in the field of advanced ceramics set R&D, manufacturing and sales as one, mainly produces porous ceramics, alumina, zirconia, silicon nitride, silicon carbide, aluminum nitride, microwave dielectric ceramics and other advanced ceramic materials. our specially invited Japanese technology expert have more than 30 years of industry experience in semiconductor field, efficiently provide special ceramic application solutions with wear resistance, corrosion resistance, high temperature resistance, high thermal conductivity, insulation for domestic and foreign customers.